Point of View: Opportunities for AI adoption in Banking

Increased CLV through a personalised customer-centric approach.

Executive summary

Traditional banks face several challenges in the modern banking landscape. These challenges arise due to the changing expectations of customers and the rapid advancements in technology.

To address these, banks must embrace innovation, invest in technology and talent, prioritize cybersecurity, and maintain a customer-centric approach while navigating regulatory requirements.

All-encompassing strategy formulation and adaptable, coherent execution are key to thriving in the dynamic banking landscape.

The important questions

- How likely is the client to purchase a product?

- How profitable is it to approach a customer with a specific offer?

- How to increase cross-sell and up-sell?

- How can we improve response rates to direct marketing campaigns?

- How to transform each contact into a sales opportunity?

Challenge description

There is a trade-off of the goals between the Marketing and Sales and Risk Departments.

Risk Department is incentivized to keep the risk levels low and to avoid customers with higher chances of default.

Marketing and Sales Department on the other hand, benefits from higher number of high-end products sold. This leaves out:

- Willing clients that are deemed risky by the Risk Department (only based on Risk features);

- Clients that are accepted by the Risk Department but are deemed to be non-interested by the CRM (only based on CRM models)

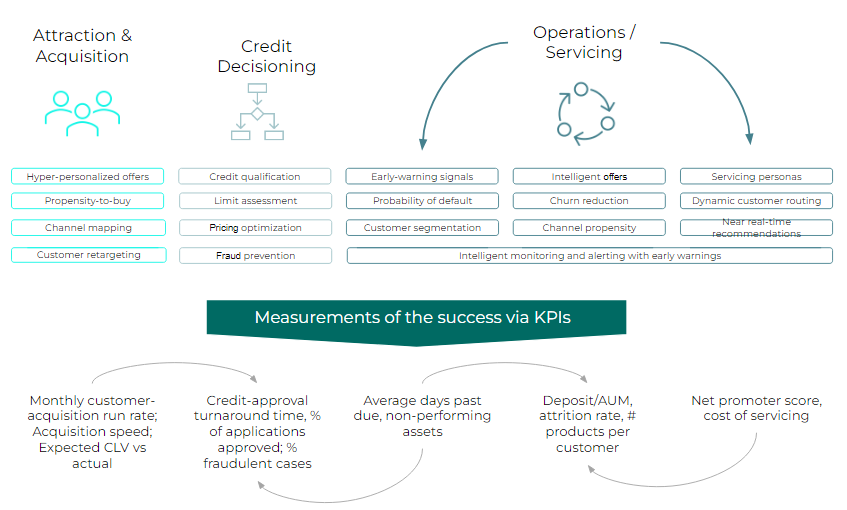

The customer lifecycle view

How is it done?

-

Customer Lifetime Value

All steps listed below, when executed in combination lead to a higher CLV with an increased NFI.

-

Personalised offering, Next Best Action, Personalised Marketing

The Next Best Action algorithm is used to predict the best ways and times to deliver enhanced customer satisfaction resulting into higher campaign response rate and deal closures. As an additional step, algorithms for personalized offerings can be incorporated into the system.

-

Next Best Offer

NBO increases revenue by predicting the most relevant products or services and up-sell/co-sell opportunities to individual customers.

-

Net Financial Impact

The models maximize the Net Financial Impact obtainable from the customers meanwhile considering the applicable risk limits.

-

Propensity to buy, Probability of Default, Expected Loss, Expected Profit, Customer Churn, Fraud Detection, and Customer Segmentation

PtB models enable the expansion and optimization of credit portfolios in competitive and saturated markets by calculating the likelihood, that customer will buy a product or a service. The solution takes into consideration further inputs and constraints.

PtB-driven solution

Current state

The traditional lending process

The traditional preapproved credit sales process consists of two steps:

- setting the preapproved limit by the Credit Risk department

- targeting the offers by the Sales/Marketing department

This approach leads to two thresholds.

Future state

Suggested approach

Considers simultaneously information from both the Sales/Marketing and Risk departments. This allows for customer targeting by risk-adjusted expected profit, thus increasing the overall profitability and size of the credit portfolio over its lifecycle.

What are the benefits of the suggested approach?

- Higher Net Financial Impact (NFI) for the bank

- Prolonged Customer Lifetime Value (CLV)

- Enhanced Customer Experience

- Improved Efficiency and Productivity

- Data-Driven Insights and Decision Making

- Regulatory Compliance

- Personalized Marketing

- Automatization of Loan Application & Approval Process

Outcomes: Banking products suggestions, driven by technology can help scale the business while lowering costs at the same time.

If you are looking for the right AI solution, get in touch with our team to help you find the best resolution for your organisation’s needs.